Mobile CRM VS Computer CRM

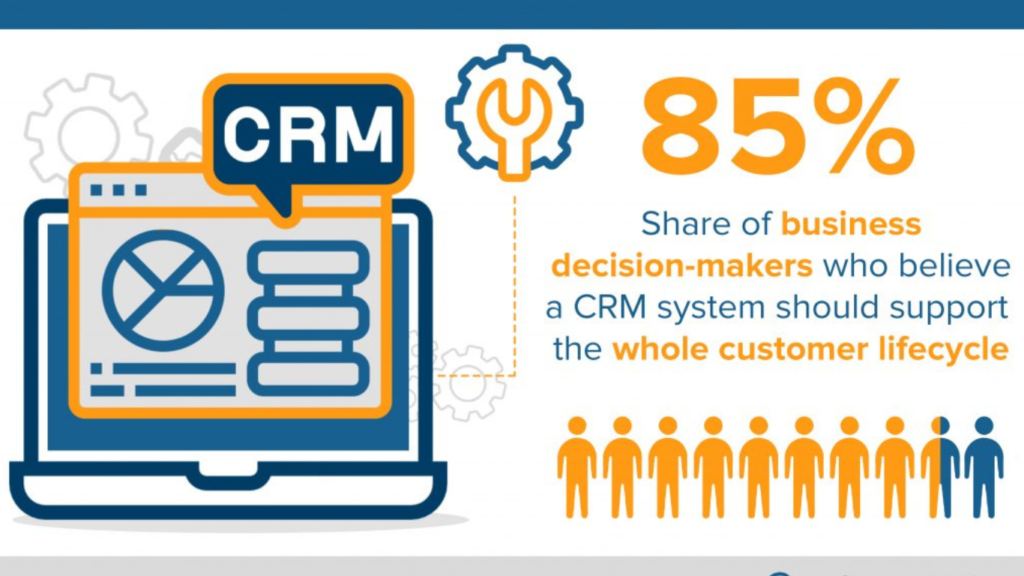

CRM (Customer Relationship Management) software is an essential tool for businesses that want to manage their interactions with customers and streamline their sales process. While both mobile and computer CRM have their advantages and disadvantages, it’s important to understand the key differences between the two. Mobile CRM is designed to be used on mobile devices […]

Mobile CRM VS Computer CRM Read More »